Vaccination programs are gaining traction under pressure from the threat of stagnating economies. According to a report by AFDB1 African countries have begun to develop testing laboratories. Strongly supported by the African Development Bank as part of the initiative to assist countries cope with the health emergency and the socio-economic consequences of the pandemic.

Though SMEs are the heartbeat of economies globally, statistics show the pandemic has disrupted lives worldwide and negatively affected global economic growth in 2020 beyond anything experienced in nearly a century2. Estimates indicate the virus reduced global economic growth in 2020 to an annualized global rate of -3.4% to -7.6%, with a recovery of 4.2% to 5.6% projected for 2021. Global trade is estimated to have fallen by 5.3% in 2020 but is projected to grow by 8.0% in 2021.

The coronavirus has radically changed how SMEs do business and according to the Kenya Private Sector Alliance (KEPSA) business survey on effects of COVID-193 , most of the education and tourism companies have had to close, at least temporarily. Findings and analysis show that in terms of financial losses, agriculture, transport, manufacturing and tourism sectors were the hardest hit.

The main question then becomes how then should SMEs think about growth and evaluating performance? Here are some quick tips:

Break down what growth means – With limited resources, SMEs need to understand the impact of the type of growth they are pursuing from an execution and risk perspective. For example, COVID 19 resulted in B2B oriented SMEs seeking out B2C markets for products such as masks and surgical gloves. An established player in the industry might execute the ‘market penetration’ quadrant faster because it is selling more product to the same type of customer’.

Execution risk is minimized as this is building on what the firm knows and has experience in. Thus ‘volume’ or ‘revenue per customer’ performance metrics make sense.

What other type of growth to pair this with, depends on several factors. In this example, is it more effective to combine selling existing products to existing clients [market penetration] with ‘cross selling’ a new product to the same client base [market development]?

Questions to ask would be -Are we addressing different needs? Does the share of wallet for our products give room for clients to purchase different products? Does our competition change? Are we making the best use of our resources? How will we measure success?

Diagram: PES presentation slide depicting the Anselm ModelHow are we making money? – SMEs typically tend to focus on margins and forget to also evaluate how well they are using the assets they own to generate revenue or generate a return for equity investors (shareholders). SMEs get caught up in the idea of purchasing new assets to increase business capacity, without thinking through how that asset purchase will be funded [equity or debt], and the actual percentage increase in productivity for the business.

When thinking about its CAPEX programme, the SME must first evaluate how efficiently it is using current assets. If the utilization is low/inefficient, identify where the challenge lies and what can be done to improve this. It might be a capacity issue – not enough raw material, unskilled staff members or lack of supporting infrastructure (access to water, electricity or even space).

Another common issue might be lack of sufficient demand from customers, meaning the assets are not running at an optimal or at full capacity. This then requires a review of how sales projections are developed, the assumptions they are based on and how to improve this process so that it better captures projections for future CAPEX programmes.

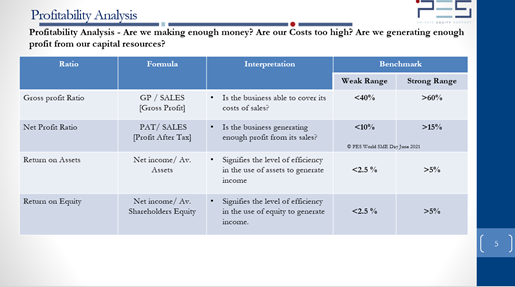

Diagram: PES presentation depicting Profitability Analysis MeasuresPES Programme Focus – WIDU

Private Equity Support (PES) is one of four originations that were selected to assist ASSEK implement the WIDU project. WIDU Africa is an online platform that aims to support entrepreneurship in Africa to upscale entrepreneurs, through coaching and business evaluation, thereby creating new jobs, increasing incomes and better economic perspectives for participating African countries.

WIDU is an initiative of the Federal Ministry for Economic Cooperation and Development (BMZ), implemented by the Gesellschaft für Internationale Zusammenarbeit (GIZ). Kenya is the 4th African country where WIDU is active and was launched in October 2020. The other 3 African countries are Cameroon, Ghana and Ethiopia. ASSEK is the implementer of the project working with PES to execute this.

PES has worked with over 20 entrepreneurs across various counties including Nairobi, Kiambu, Kisumu, Lodwar, Kilifi, Nyeri, Kajiado, Makueni, Mombasa, Machakos, Malindi and Kitui.

This segment highlights some of our experiences with our clients and our takeaways.

Entrepreneur: Illya Bryant

Project name: Growably Agri Ventures

Business location: Kiambu, Kenya

Brief on business: Illya Bryant an entrepreneur based in Kiambu, founded Growably Agri Ventures that grows capsicum and leafy greens. Illya says it has been a great opportunity getting the grant for WIDU as it has significantly improved his business. He’s now able to produce half a ton on a weekly basis which is above average what people are producing, catapulting Growably Agri Ventures to the top producers of the local market.

The workload is heavy as the farm has 800 plants. Therefore, Illya’s business has assisted with job creation in the community. Growably Agri Ventures has also invested in technology by installing CCTV cameras, which is a fundamental tool that keeps the farm secure along with maintaining the well-fare of the farms employees and operations.

Entrepreneur quote on PES experience: ‘PES taught me good record keeping for my business, storing and managing records and information appropriately.’

Previous Events

World SME Day 2021- PES Webinar

To commemorate World SME Day 2021, PES held a two-day webinar on 30th June and 1st July. Focusing on our July theme of ‘Performance Analysis for SMEs in a COVID 19 environment’, the webinar took SMEs through how investors thought about performance and what aspects they could borrow to improve their own evaluation process.

Key takeaways were how SMEs can better understand which performance metrics were important to measure depending on the strategy being adopted and how best to track progress. Highlighting factors that an SME could exert some control over and separating this from the capacity of an SME to react to factors in its operating environment brought upon by COVID 19.

The speakers included PES team members, including Diana Gichaga and Esther Kahuko. We were honored to also host Sally Ndunda, Investment Manager at Incofin Investment Management and Emmanuel Mudahemuka, Consultant at MDX Consulting and part of the PES pool of experts.

Upcoming events

- Webinar: 8th September 2021 Financial Literacy for SMEs.

- Strategy session for SMEs. 29th & 30th September 2021.

[1].AFDB https://www.afdb.org/en/news-and-events/covid-19-african-countries-win-race-against-time-testing-laboratories- 44228

[2] Congressional Research Service: Global Effects of Covid-19 https://fas.org/sgp/crs/row/R46270.pdf

[3] XINHUANET: Kenya’s tourism and education sectors most affected by Covid-19 Pandemic http://www.xinhuanet.com/english/2020-05/08/c_139038856.htm